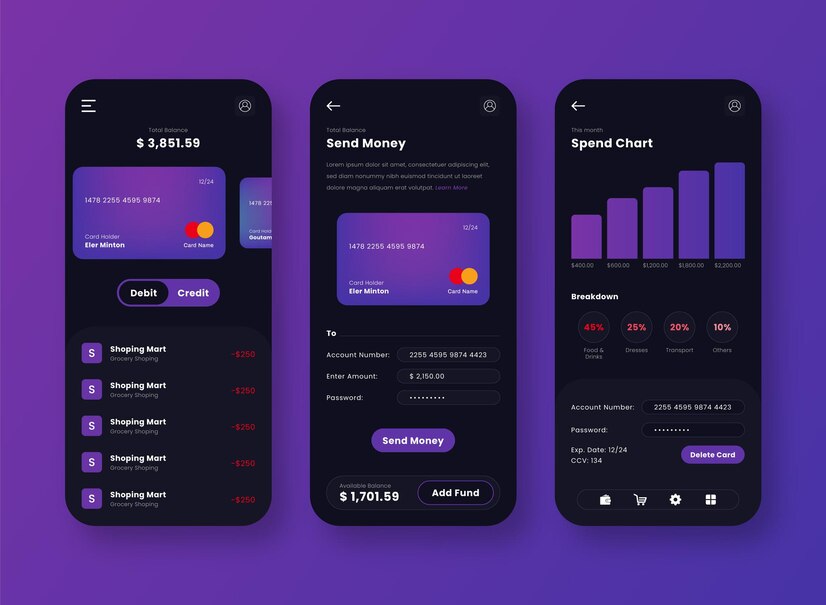

As a micro-entrepreneur, juggling cash flow management, invoicing, expense tracking and administrative obligations can quickly become a headache. Fortunately, there are now mobile applications for keeping track of your finances that allow you to manage your business easily from your smartphone.

Here is a selection of the 5 best mobile applications for keeping track of your finances and optimising the management of your micro-business in 2025.

1. Gestion Micro-Entrepreneur (Gestion-ME)

Specially designed for micro-entrepreneurs, Gestion-ME is an iOS application that centralises all your accounting and administrative operations. It can be used to create quotes and invoices, record receipts and purchases, monitor cash flow and automatically generate mandatory documents such as the receipts book or URSSAF declaration.

The application runs locally on your device, guaranteeing the confidentiality of your data. It's ideal for those who want an all-in-one solution, without complex subscriptions.

👉 Available on the App Store : Apple

2. Linxo

Linxo is a budget management application that automatically synchronises your bank accounts to give you a clear picture of your finances. It categorises your spending, anticipates your future balance and alerts you if you go over budget.

Thanks to its intelligent forecasts, Linxo helps you plan your business and personal expenses more effectively. It's an invaluable tool for micro-entrepreneurs who want to keep control of their cash flow.

👉 Find out more about Linxo : Eco Essentials

3. Freebe

Freebe is an application dedicated to freelancers and micro-entrepreneurs, offering an intuitive interface for managing invoicing, quotes, payment tracking and URSSAF declarations. It automates many administrative tasks, allowing you to concentrate on your core business.

The application also offers reminders for tax deadlines and a clear dashboard for tracking your sales.

👉 Discover Freebe: Obat

4. Bankin'

Bankin' is a benchmark application for automatically tracking your finances. It connects to your bank accounts to categorise your spending, providing interactive graphs and personalised advice.

For micro-entrepreneurs, Bankin' provides an overview of cash flow, making it easier to take informed financial decisions.

👉 More information about Bankin' : Eco Essentials

5. My Auto-Entrepreneur Portal

Mon Portail Auto-Entrepreneur is a comprehensive platform that makes life easier for auto-entrepreneurs. It offers essential features such as automatic invoice creation, accurate expense tracking and simplified management of customer information. What's more, the intuitive user interface provides quick access to tools, making day-to-day management more efficient and less time-consuming.

Why use mobile applications to keep track of your finances?

Mobile applications for keeping track of your finances offer many advantages for micro-entrepreneurs:

- Time saving Automating repetitive tasks and reducing errors. finary.com

- Accessibility Access to your financial data in real time, wherever you are.

- Security Protection of your sensitive information thanks to advanced security protocols.

- Compliance : Help with complying with current legal and tax obligations.

By integrating these tools into your daily routine, you can optimise the management of your micro-business and concentrate on what's most important: developing your business.

Conclusion

Choosing the right application to track your finances depends on your specific needs. Whether you're looking for an all-in-one solution like Gestion-ME, a budget management application like Linxo or a tool dedicated to freelancers like Freebe, there's an application to suit your profile.

Don't hesitate to try out several options to find the one that best suits your way of working. Mobile applications for tracking your finances are invaluable allies in managing your micro-business effectively in 2025.