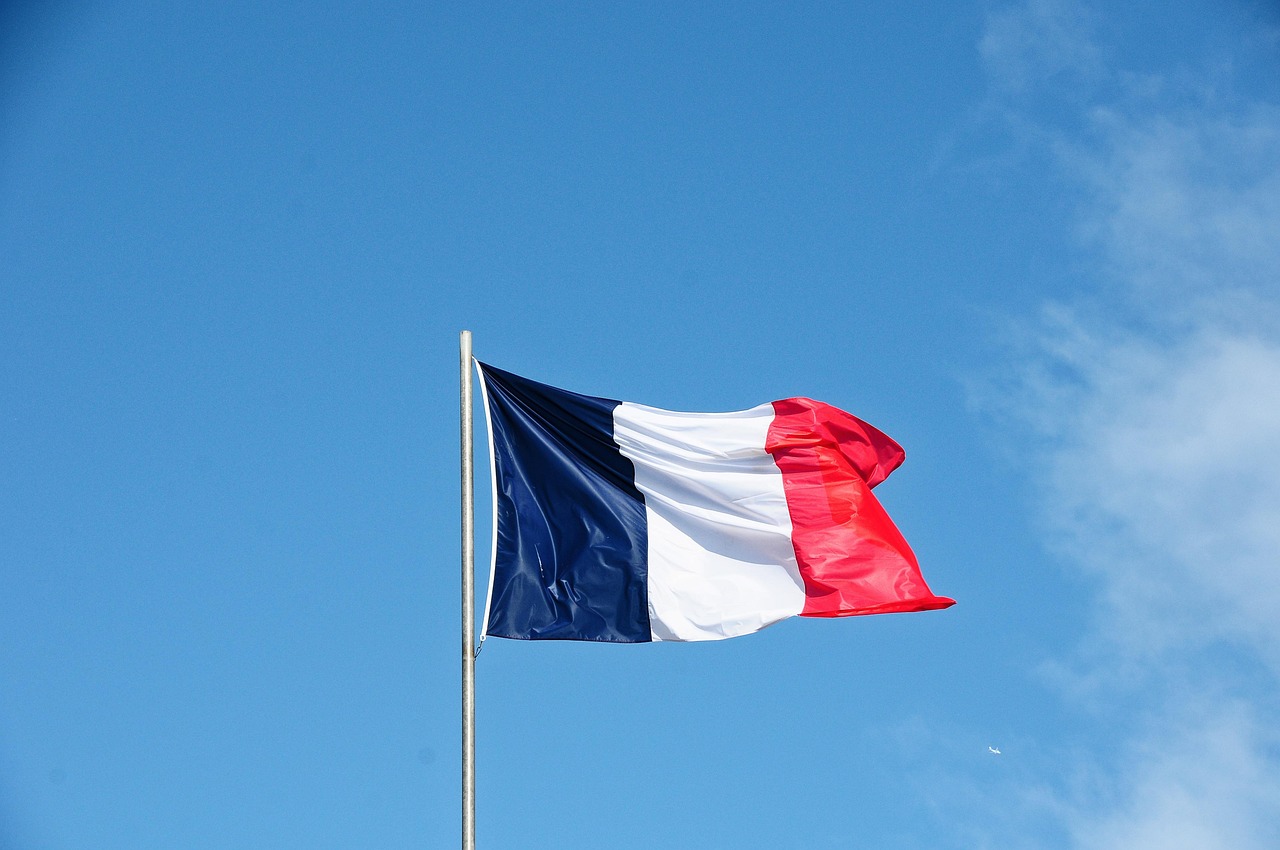

L'French economy is producing signs that are difficult to interpret. The indicators are not all pointing in the same direction. On the one handinflation is slowing down. On the other, the consumption is stagnating. L'job The economy is holding up, but the pressure on purchasing power persists. You may feel it on a daily basis: official figures struggle to reflect what households and businesses are experiencing. Behind the percentages and curves, a complex reality emerges, made up of contrasts and uncertainties.

Inflation, employment, consumption: an economy under pressure

France, like the rest of Europe, went through a period ofinflation strong after 2021. Energy, food and commodity prices have risen. This has weighed heavily on households and businesses. Yet despite this shock, thejob remained steady. The unemployment rate remains at around 7 %, a historically low level.

This paradox raises questions. How can we explain the fact that business is slowing down without triggering a wave of redundancies? Part of the answer lies in the resilience of services and public support. As you have no doubt noticed, companies have preferred to keep their staff rather than make drastic cuts. After the post-Covid labour shortages, nobody wants to go through the same disorganisation again.

But this apparent stability masks a fragility. Recruitment is slowing, productivity is stagnating and real wages are struggling to keep pace with prices. For many households, the consumption remains constrained.

Inflation is falling, but not for everyone

Yes, the figures show a downturn. L'inflation in France fell from over 6 % to around 2.5 % over the year. An apparent relief. But as you know, not all prices are falling in the same way. Energy prices have stabilised, but food prices remain high. The average household shopping basket remains higher than before the crisis.

This situation fosters a sense of injustice. When we talk aboutinflationWe're talking about the average. But depending on your income level, where you live and your spending habits, your perception of the cost of living can vary by as much as double.

The working classes, who are more exposed to spending constraints (housing, transport, food), continue to come under heavy pressure. The middle classes, on the other hand, are cutting back on leisure activities and postponing major projects. This slowdown in consumption mechanically weighs on growth.

Employment: resistance that raises questions

The labour market remains surprisingly robust. Job creation is slowing down, but not collapsing. The health, digital and hospitality sectors are still recruiting. You hear about it: companies sometimes lack candidates more than they lack jobs.

However, the reality is more nuanced. Behind the overall stability, certain categories of working people are under threat. The situation of young people, senior citizens and precarious workers is deteriorating. Short-term contracts are on the increase. And although wages are rising, they are not fully compensating for the drop in employment.inflation.

La consumption depends to a large extent on this income. When take-home pay rises less than the increase in the cost of living, the loss of purchasing power becomes inevitable. You feel it in your daily life: an unchanged salary no longer buys the same things as it did two years ago.

Consumption at half-mast, a symptom of lasting concern

The French are spending less. Not out of choice, but out of caution. After years of uncertainty - pandemic, energy crisis, geopolitical tensions - confidence remains fragile.

La consumption the traditional driving force behindFrench economyis not regaining its vigour. Households are opting for precautionary savings. High interest rates are putting the brakes on property purchases and personal investments. Even sales and promotions are no longer enough to boost sales.

Businesses, for their part, are seeing their margins shrink. Production costs remain high, particularly in industry and construction. This combined drag from demand and costs is weighing on growth.

An unstable balance between resilience and running out of steam

L'French economy gives the impression of holding out, but with no momentum. Public policies are cushioning the shocks, at the cost of massive debt. The state supports households with targeted subsidies, and businesses with tax credits and reduced social security contributions.

This strategy has made it possible to avoid recession, but it is reaching its limits. Our budgetary room for manoeuvre is shrinking. As you may have noticed, local taxes are rising, some subsidies are being reduced, and regulated prices are changing. The country is trying to reconcile social justice and budgetary rigour, a difficult balance to maintain.

L'inflationeven at a slower pace, remains a discreet poison. It nibbles away at confidence, modifying purchasing behaviour and fuelling mistrust of economic policies.

Companies face double pressure

For you as a business owner, the situation is paradoxical. Order books are holding up, but margins are shrinking. The cost of raw materials and energy remains unstable. Rising wages, necessary to retain talent, are weighing on profitability.

Some companies are reacting by automating more, reducing their marketing spend or outsourcing certain functions. Others are betting on moving upmarket or innovating to absorb the cost pressures.

But this adaptation is not possible for everyone. Small businesses, particularly in the retail and craft sectors, are bearing the full brunt of the contraction of the economy. consumption. As you know, when households cut back on spending, it's the local players who bear the brunt the earliest.

The decisive role of trust

Basically, the dynamics ofFrench economy depends on an often underestimated factor: confidence. If households believe in the future, they will consume. If businesses perceive stability, they invest.

But for several years now, this confidence has been crumbling. Successive crises have left their mark psychologically. You may be feeling it yourself: the impression that everything can change overnight is holding back decisions.

Yet there are positive signs. Public investment in the energy transition, industrial relocations and job growth in certain strategic sectors all point to a potential rebound. L'inflationThe fall in taxes is giving budgets some breathing space.

Where are we heading?

Economists remain cautious. The most likely scenario is one of slow stabilisation. L'inflation should continue to fall, without returning to pre-crisis levels. L'job would continue, but the consumption is expected to remain weak, held back by interest rates and the cautious attitude of households.

For you, this means a period of adjustment. We'll have to keep an eye on the weak signals: changes in the cost of credit, wage dynamics, consumer behaviour.

If France manages to preserve employment while keeping its public finances under control, it could avoid a lasting recession. But if the consumption continues to contract, growth could falter further.

The French economy at a crossroads

L'French economy is treading a fine line. It is neither in deep crisis nor in full-blown recovery. It is resisting, but without regaining its vitality. L'inflation, l'job and the consumption form a triangle of precarious equilibria in which each variable influences the other two.

You experience this reality on a daily basis, whether you are an employee, self-employed or a manager. What these contradictory signals reveal is that the economy is not just a matter of figures. It is a collective story, made up of decisions, trust and perceptions.

Understanding these mechanisms is already preparing for what comes next. And in this uncertain climate, lucidity remains the best protection.